Investors will remain a significant player in the housing market as the LVR speed limits imposed by the Reserve Bank kick in this month.

This is according to the latest release from QV.

The LVR speed limits returned at the start of March, but it might be quite some time before we see these significantly impacting the market.

Most investors are now required to stump up a 30 per cent deposit to grow their portfolio.

Owner occupiers now require a 20 per cent deposit from the start of March.

'With capital gains averaging over 15 per cent for the past 12 months, we're still seeing many investors restructuring their finances to get around these restrictions,” says QV general manager David Nagel.

'Investors will need a 40 per cent deposit from May 2021, which could finally dampen their ability to compete with the first-home buyers for the very limited affordable housing stock.”

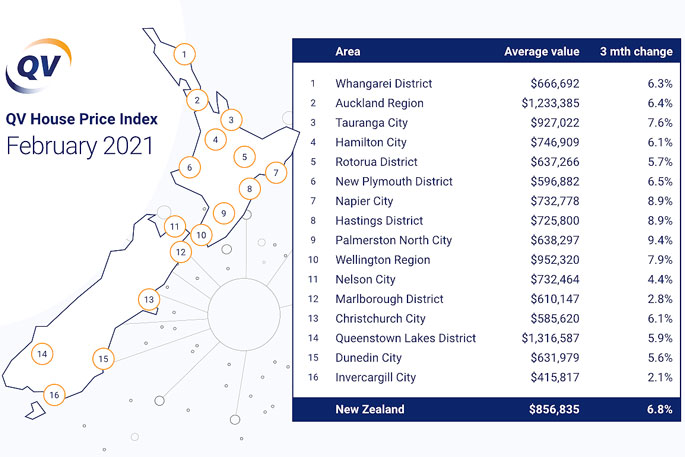

The average value increased 6.8 per cent nationally over the past three-month period, up slightly from the 6.3 per cent quarterly growth we saw in January, with the average value now sitting at $856,835.

This represents an increase of 15.9 per cent year-on-year, an increase from annual growth of 15.1 per cent last month.

Rotorua's average residential property value continues to push to new heights.

It crossed the $600,000 mark for the first time in January; by the end of February, it was already $637,266 − 15.3 per cent higher than it was at the same time last year.

QV's local property consultant Derek Turnwald says there was strong demand in all value ranges across Rotorua, but value rises had been particularly high in the suburbs where housing values were typically more modest, such as Koutu and Fordlands.

'Competition is very high between investors and first home buyers in these suburbs,” he says.

'Demand has also been very strong for houses around the Rotorua lakes. One of the possible reasons for this is the inability to travel overseas has increased interest in our own local beautiful places − people have an increased interest in holiday homes with water views again.”

'Most listings are still resulting in multi-offer sales − with sometimes more than 10 offers,” he said. 'There continues to be very strong attendance of open homes and auctions – although some agents are reporting a reduction in the number of appraisals they are being asked to prepare for prospective sellers, which could mean the number of future listings may be about to drop even further.”

Meanwhile, listing periods are amongst the shortest since records began, with FOMO still prevalent among first-home buyers in particular.

'Very few properties are being sold now beneath a $400,000 threshold for an existing home or $500,000 for a new home.”

The average value in the Auckland region sits at $1,233,385, up 6.4 per cent over the last quarter, with annual growth at 14.2 per cent, up from January's year-on-year growth of 13.4 per cent.

All the major urban centres are showing strong gains in value with Palmerston North continuing to lead the way with 9.4 per cent growth over the past three months.

The twin Hawke's Bay cities of Napier and Hastings aren't far behind with both cities showing quarterly growth of 8.9 per cent.

'The larger centres were generally the first parts of the country to experience the very rapid value growth we've seen over the past 12-18 months, and this was primarily driven by both first-home buyers and investors competing for the very limited supply of entry-level housing stock. But the market strength has now spread to the higher-value locations in the major centres as confidence returns in the post-lockdown economic recovery,” says David.

'We may see a gradual cooling of the market in the second and third quarters of 2021, particularly in the entry-level locations as property investors reach their credit limits and first-home buyers struggle to raise a big enough deposit. But with the long-term forecast for housing demand in New Zealand looking positive, it is difficult to see the market take a significant turn for the worse any time soon.”

0 comments

Leave a Comment

You must be logged in to make a comment.