Slow and steady growth appears to be on the cards for New Zealand’s housing market in 2024, as evidenced by a general stalling in home value growth this quarter.

The latest QV House Price Index shows home values have increased across all of the main urban centres monitored, but at a reduced rate overall.

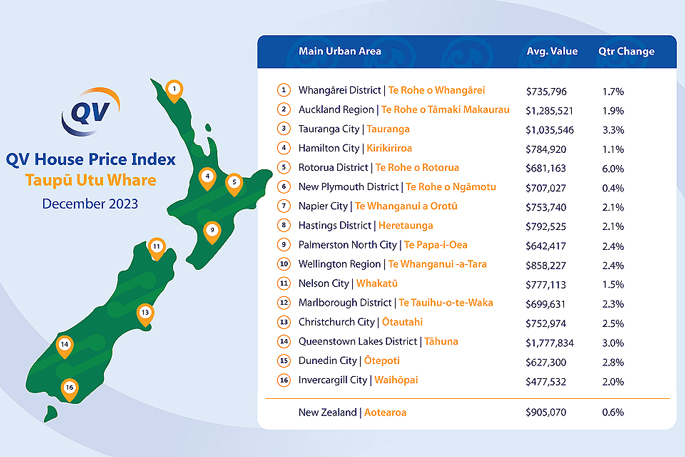

The average home value increased nationally by just 0.6 per cent throughout the December quarter to $905,070, down from the 2.3 per cent quarterly home value increase reported at the end of November.

Across the main centres, Rotorua (6 per cent) and Tauranga (3.3 per cent) recorded the most home value growth on average in the December quarter, with the latter recovering from a small deficit in the previous month’s figures.

New Plymouth (0.4 per cent) recorded the smallest increase on average, while Auckland (1.9 per cent), Wellington (2.4 per cent) and Christchurch (2.5 per cent) continue to experience relatively robust growth by national standards.

Quotable Value operations manager James Wilson says the latest data demonstrates how volatile value trends can be, given current market conditions.

“With relatively low sales volumes in many markets across the country it doesn’t take much change in activity to change the overall value performance.

“This slight stalling in the rate of home value growth nationally could well be a result of the increase of new property listings and stock available for purchase, which came to the market throughout the last few months of the year and allowed supply to balance demand in some key markets, thereby suppressing competition.

“In the short term, this influx of new listings should result in market activity increasing throughout January and February. Competition among those buyers who couldn’t find their next property in 2023 will remain in place to some degree, but this will likely be subdued over the first couple of months of 2024 as it’s met by an increase in stock available.”

Notwithstanding unforeseen extreme weather events such as those we experienced around this time last year, James expects home values to continue to strengthen at broadly similar levels over the next few months, then eventually slow as we move into the autumn months.

“High net migration remains in place, increasing demand and putting pressure on the rental market, and the expected reintroduction of interest deductibility for property investors will also certainly impact the housing market. However, the biggest handbrake to home value growth right now is interest rates, which are expected to remain at current levels throughout much of 2024 as the Reserve Bank looks to reduce stubbornly high inflation levels.

“While many buyers and sellers remain relaxed to the impacts of climate change and natural hazards on their properties, the winds of change are beginning to blow, so watch this space in the year ahead. The nationwide land risk classification framework that is currently being assessed across the country also has the potential to significantly and quickly change the housing market in higher risk areas.

“Insurers have already signalled their intent to re-price or remove the ability to insure within certain risk areas, which will change the game for some locations and re-set value fundamentals.”

Tauranga

Tauranga has managed to buck the general trend of stalling home values nationally this quarter.

It has reversed the small deficit reported in our previous QV House Price Index, with the city’s average home value increasing by 3.3 per cent to $1,035,546. throughout the last three months of 2023, finishing the calendar year just 3.8% lower than it began.

“Tauranga’s average home value has now increased slightly for the third month in a row, which indicates that the market has stabilised now,” says local QV registered valuer Meghan Crowe.

“Tauranga’s population continues to grow, which brings with it fresh demand for housing. Though high mortgage rates are likely to continue to impact buyers and owners. The next six to 12 months will be interesting – local real estate agents report some positive market activity post-election, with more properties likely to be coming to market.”

0 comments

Leave a Comment

You must be logged in to make a comment.